Page 7 - EQ Mag-2019

P. 7

CREDIT RESOURCE

The unscoreables

problem gets worse

By: Barrett Burns

as the plight of the conventionally unscoreable little solace to the consumers directly (and even

worsened? Unfortunately, based on a recent adversely) impacted.

HVantageScore analysis, it has been exacerbated.

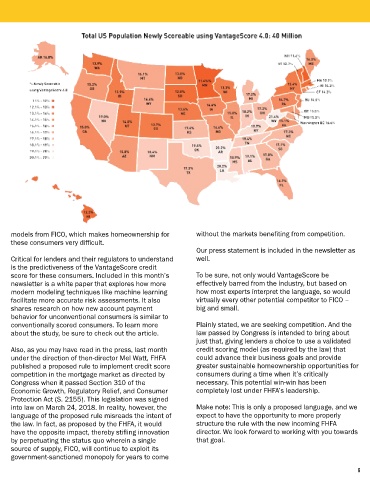

Consider this map (on page 6) of the United States

As the overall population has increased, so has the that shows the percentage of consumers within each

number of consumers who are not scoreable when state who fall into the conventionally unscoreable

conventional credit scoring models are used. Indeed, we category but can obtain a score using our latest

estimate that based on the 2017 U.S. Census, the model.

overall population grew to more than 326 million and the

models from FICO, which makes homeownership for without the markets benefiting from competition.

these consumers very difficult.

Our press statement is included in the newsletter as

Critical for lenders and their regulators to understand well.

is the predictiveness of the VantageScore credit

score for these consumers. Included in this month’s To be sure, not only would VantageScore be

newsletter is a white paper that explores how more effectively barred from the industry, but based on

modern modeling techniques like machine learning how most experts interpret the language, so would

facilitate more accurate risk assessments. It also virtually every other potential competitor to FICO –

shares research on how new account payment big and small.

number of conventionally unscoreable consumers (who There are significant pockets across the country, but behavior for unconventional consumers is similar to

can now be scored with the VantageScore model) also states located in the South are clearly conventionally scored consumers. To learn more Plainly stated, we are seeking competition. And the

increased to approximately 40 million. disproportionately impacted. about the study, be sure to check out the article. law passed by Congress is intended to bring about

just that, giving lenders a choice to use a validated

By contrast, according to the 2010 U.S. Census, the Minority borrowers are also deeply affected. Our data Also, as you may have read in the press, last month credit scoring model (as required by the law) that

overall population was about 309 million; of which 30 to shows that approximately 12.2 million African- under the direction of then-director Mel Watt, FHFA could advance their business goals and provide

35 million were conventionally unscoreable, but could be American and Hispanic consumers are conventionally published a proposed rule to implement credit score greater sustainable homeownership opportunities for

scored using the VantageScore model. unscoreable (approximately 2.4 million have scores competition in the mortgage market as directed by consumers during a time when it’s critically

above 620), and approximately 1.6 million Asian and Congress when it passed Section 310 of the necessary. This potential win-win has been

The proportion of the adult population that is Pacific Islander consumers are also in this category Economic Growth, Regulatory Relief, and Consumer completely lost under FHFA’s leadership.

conventionally unscoreable (but can be scored by (with more than 0.5 million with scores above 620). Protection Act (S. 2155). This legislation was signed

VantageScore) remains stable at nearly 16 percent. This into law on March 24, 2018. In reality, however, the Make note: This is only a proposed language, and we

represents an opportunity to make credit markets more These consumers, despite the fact that they have language of the proposed rule misreads the intent of expect to have the opportunity to more properly

accessible to additional consumers who have been relatively low credit risk, face high-interest rates and the law. In fact, as proposed by the FHFA, it would structure the rule with the new incoming FHFA

historically underserved. other potential adverse terms—if they can even have the opposite impact, thereby stifling innovation director. We look forward to working with you towards

access credit at all. Mortgage lenders, when offering by perpetuating the status quo wherein a single that goal.

While this is perhaps an argument for lenders to use loans to Fannie Mae or Freddie Mac, are required to source of supply, FICO, will continue to exploit its

more inclusive models such as VantageScore, that is of use the same old pre-Great Recession scoring government-sanctioned monopoly for years to come

5 www.equitymovement247.com 6